What do I claim on my W4 to get the most money?

Claiming 0 Allowances on your W4 ensures the maximum amount of taxes are withheld from each paycheck. Plus, you'll most likely get a refund back at tax time.

By placing a “0” on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period.

To receive a bigger refund, adjust line 4(c) on Form W-4, called "Extra withholding," to increase the federal tax withholding for each paycheck you receive. Tax withholding calculators help you get a big picture view of your refund situation by asking detailed questions.

Claiming more allowances will lower the amount of income tax that's taken out of your check. Conversely, if the total number of allowances you're claiming is zero, that means you'll have the most income tax withheld from your take-home pay.

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

When you claim 0 on your taxes, you have the largest amount withheld from your paycheck for federal taxes. If your goal is to receive a larger tax refund, then it will be your best option to claim 0.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

If you want less taxes taken out of your paychecks, perhaps leading to having to pay a tax bill when you file your annual return, here's how you might adjust your W-4. Increase the number of dependents. Reduce the number on line 4(a) or 4(c). Increase the number on line 4(b).

By adjusting your W-4 withholdings downward, you can score a near-instant pay raise. How much? If your last refund was $2,500, a W-4 adjustment could put just over $200 more in your pocket each month. Then, you can stash the cash in a high-yield savings account to earn even more.

The largest amount withheld from your wages is usually for federal income taxes.

How to fill out W4 to get more money on paycheck?

If you are someone who likes receiving a bigger tax refund with your annual return, changing your W-4 form to get more money with your refund is easy. You can choose what additional amount, if any, you want withheld from each paycheck on line 4(c) of the W-4 form.

If you claimed 0 and still owe taxes, chances are you added “married” to your W4 form. When you claim 0 in allowances, it seems as if you are the only one who earns and that your spouse does not. Then, when both of you earn, and the amount reaches the 25% tax bracket, the amount of tax sent is not enough.

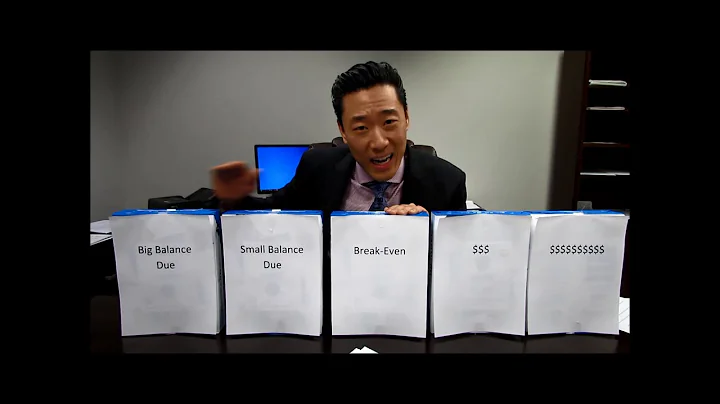

if you claim 0, you may have a few dollars less in your paycheck and then get it back at the end of the year as a refund. If you 1, you could owe something at the end of the year. The perfect return is to not owe any money and not get a refund.

You can adjust your W-4 at any time during the year. Just remember, adjustments made later in the year will have less impact on your taxes for that year.

For federal tax withholding: Submit a new Form W-4 to your employer if you want to change the withholding from your regular pay. Complete Form W-4P to change the amount withheld from pension, annuity, and IRA payments.

You cannot claim yourself as a dependent on taxes. Dependency exemptions are applicable to your qualifying dependent children and qualifying dependent relatives only. You can, however, claim a personal exemption for yourself on your return. Personal exemptions are for you and your spouse.

If you want to avoid a tax bill, you may need to change your withholding. Changes in your life, such as marriage, divorce, working a second job, running a side business or receiving any other income without withholding can affect the amount of tax you owe.

Dhowan said that in order to pay zero tax, individuals under the new tax regime need to bring their income down up to Rs. 7,00,000 after claiming a standard deduction of Rs. 50,000. "Certain deductions and exemptions such as HRA, LTA, etc.

Use the Tax Withholding Estimator on IRS.gov. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. They can use their results from the estimator to help fill out the form and adjust their income tax withholding.

It's possible. If you do not have any federal tax withheld from your paycheck, your tax credits and deductions could still be greater than any taxes you owe. This would result in you being eligible for a refund. You must file a tax return to claim your refund.

Which filing status gives the biggest refund?

Select the Right Filing Status

The status you use could significantly alter your refund. For instance, a person is allowed to file as a qualifying widow(er) for the two years after their spouse's death. This status nearly doubles the standard deduction someone would receive if they filed as single.

If you'd rather have a bigger paycheck and a smaller refund, you can control this. All you have to do is submit a new Form W-4 to your employer to adjust your federal income tax withholding.

If you want to get more money back in your tax refund each year, you can designate that a larger amount of your paycheck is withheld. It's simple -- just enter the extra amount you want withheld from each paycheck on line 4(c) of your W-4 form. The line is marked "Extra withholding."

If you want less taxes taken out of your paychecks, perhaps leading to having to pay a tax bill when you file your annual return, here's how you might adjust your W-4. Increase the number of dependents. Reduce the number on line 4(a) or 4(c). Increase the number on line 4(b).

You can set up extra withholding for non-wage income

Just put the estimated total amount of this income for the year on Line 4(a) of your W-4 form, and your employer will calculate the proper withholding amount for each pay period. Don't include income from a side gig on Line 4(a).